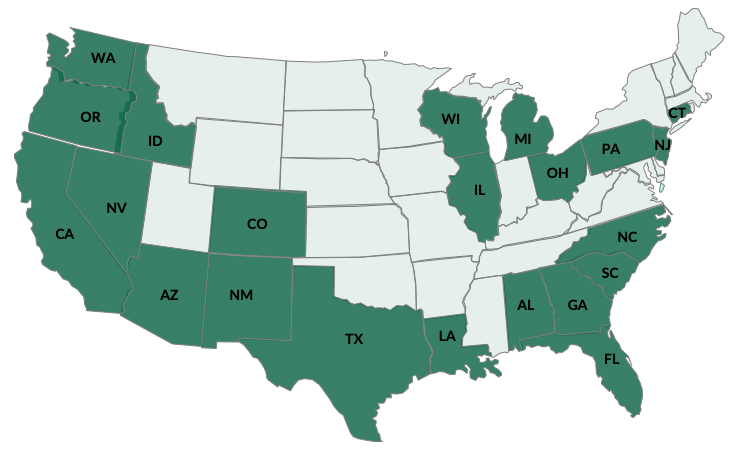

Since our founding in 2010, The Realty Bankers has completed 300+projects ($100+MM in value) in 20 states without a single loss of investor capital. Our goal has been to deliver attractive risk-adjusted returns to our investors as a provider of capital to single family and multifamily real estate developers and operators.

Extensive Deal-Sourcing Network

Discerning Market Selection

Thorough Due Diligence

Disciplined Underwriting

Optimal Capital Structure

Extensive Deal-Sourcing Network

Proactive Asset Management

Accounting Controls and Oversight

Communication with Investors

Assessment of Exit Timing

"I consider Bill and Jeff not only as a dependable source of flexible and creative capital, but as important partners in my business. They provide valuable guidance and insights throughout the life of a project including asset selection and valuation, property business plans, capital structuring, and disposition timing and strategies."

– Chad Sutton, Managing Partner, Quattro Capital

"Since The Realty Bankers provides me with a funding program, I can focus my time entirely on identifying and executing manufactured housing opportunities. Jeff and Bill are very easy to work with and they approve and fund my deals quickly."

– Adam Quick, President, Nuveau Homes